It’s not just a GOP talking point. Even Democrats admit that the U.S. corporate tax rate is too high and puts American companies at a disadvantage w/ the rest of the world.

September 19, 2017

It’s not just a GOP talking point. Even Democrats admit that the U.S. corporate tax rate is too high and puts American companies at a disadvantage w/ the rest of the world.

September 19, 2017

It’s not just a GOP talking point. Even Democrats admit that the U.S. corporate tax rate is too high and puts American companies at a disadvantage w/ the rest of the world.

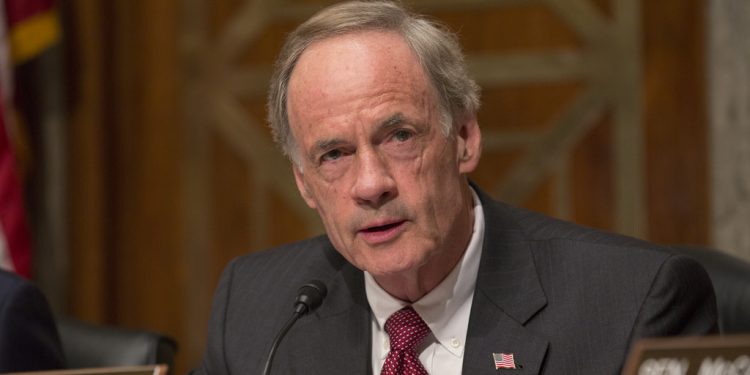

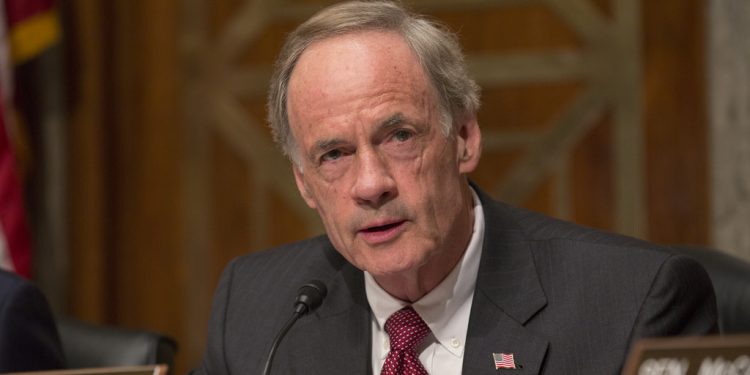

SENATOR TOM CARPER (D-DE): I’m all for reducing the corporate tax rate – we’re not competitive with the rest of the world. There needs to be a reduction. I hope that as we address that concern, we will keep in mind four questions as we address more broadly comprehensive tax reform. Number one, the proposals that come before us, is it fair? Number two, does it foster economic growth or impede it? Number three, does it make the tax code more complex or less complex? And number four, what is the fiscal impact? We are six, seven years into the longest-running economic expansion in the history of our country, and usually at this point in time, we would, I would think we’d be interested in addressing corporate tax problems so we’re competitive with the rest of the world, but do so in a way that is fiscally sustainable.

He’s not the first Democrat to agree with Republicans on this issue. Ohio Congressman Tim Ryan expressed similar sentiments last month and even officials like Barack Obama and Nancy Pelosi have called for a corporate tax reduction in the past.