January 28, 2022

January 28, 2022

The Commerce Department’s Personal Consumption Expenditures index – the Federal Reserve’s preferred measure of inflation — surged 5.8 percent year over year, the fastest rate in 40 years. Additionally, consumer spending decreased, another indicator that the economic recovery may be faltering.

Associated Press: A measure of prices that is closely tracked by the Federal Reserve rose 5.8% last year, the sharpest increase since 1982, as brisk consumer spending collided with snarled supply chains to raise the costs of food, furniture, appliances and other goods.

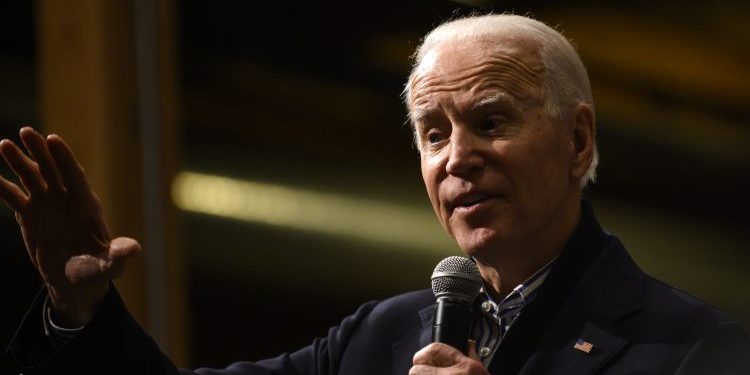

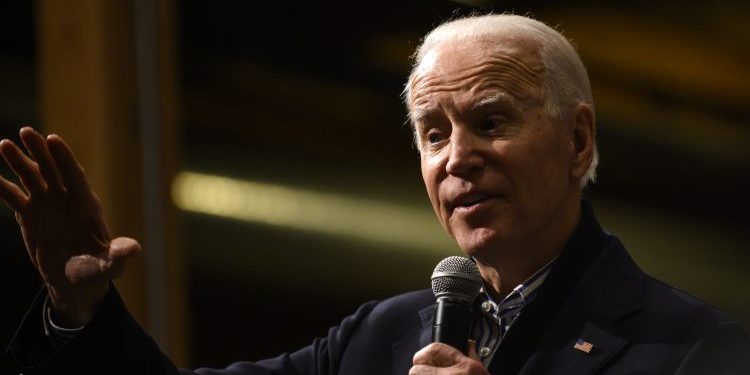

The report Friday from the Commerce Department also said that consumer spending fell 0.6% in December, with purchases of cars, electronics, and clothes declining. . . Stubbornly high inflation has hammered household budgets, wiped out last year’s healthy wage gains and posed a severe political challenge to President Joe Biden and Democrats in Congress.

Runaway inflation, which is outpacing wage gains, means that many working families have effectively taken a pay cut.

Washington Post: Although average hourly wages rose 4.7 percent last year, overall wages fell 2.4 percent on average for all workers, when adjusted for inflation, according to the Labor Department. . .

In interviews with more than a dozen workers, many said that despite considerable pay raises — as much as 33 percent, in some cases — they were still struggling to cover basic expenses. Several workers said they had taken second jobs to keep up with rising costs for groceries, gas and rent.

Bottom Line: Joe Biden and Washington Democrats promised a strong economic recovery, but surging inflation has left working families worse off than they were a year ago.